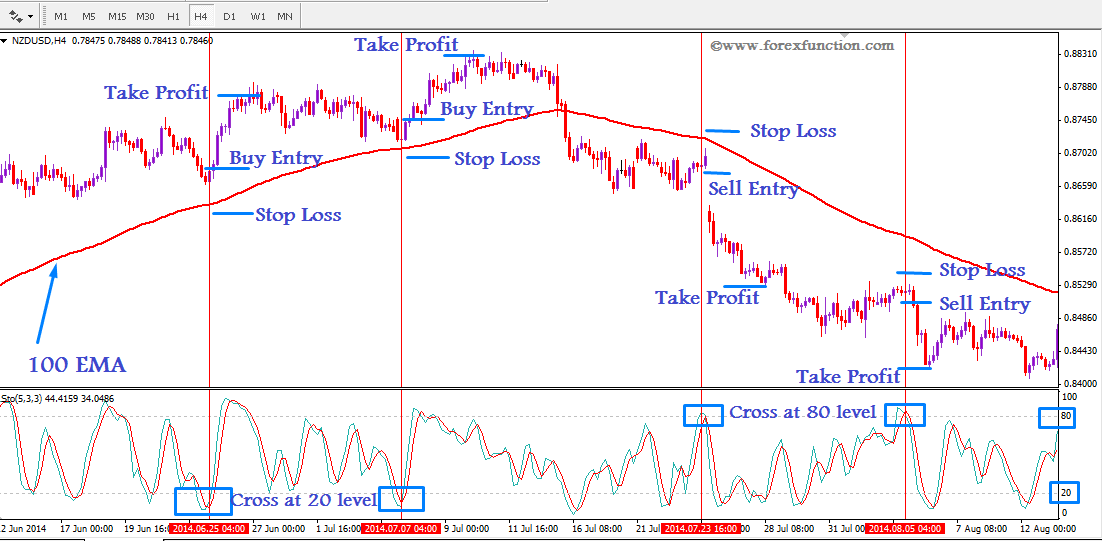

EMA CrossoversĮxponential Moving Average (MA) cross-overs are powerful signals for assessing price trends.ĮMA cross occurs when a short-term EMA crosses the long-term EMA, either above (bullish, uptrend) or below (bearish, downtrend). 200 day EMA is a good indicator of a long term trend.įor newbies, you can put the odds in your favor by only taking buys in an uptrend (aka “Buy the dips”) or sells in a long term downtrend (aka “Sell the pullbacks”). Lower timeframe is more subject to noise and false signals, so it’s not recommended under 1h.Īlso, ideally, only take LTF (lower time frame) trades in the direction of the HTF (higher time frame)Īlso, the long term positioning of EMAs helps avoiding whipsaw trades (whether 14/50 EMA are above or below the 200 EMA on the daily chart). You can use lower time frames for shorter trades and higher timeframes for longer. If you’re in an overall sideways market, you may want to drop down to a timeframe or two to do shorter term EMA crossovers (4h or 1h).īCH is an example of where this strategy would get whipsawed in a sideways trading range, without catching a substantial uptrend.ĮMA crossovers work on any timeframe (15 min, 1h, 4h, 12h, 1d). EMA crossovers work best in trending markets. This happens in times of sideways consolidation. That is, it may signal Buy only to signal Sell soon afterwards. This strategy, like many others using indicators, has a weakness – it may lead to whipsawing. (note that our performance calculations use closing price one day after crossover day, to be conservative) Here it’s clear: when EMA 12 crosses below EMA 50, or price dips below EMA 50.

Often, timing trade exit (at a loss or profit) is the toughest part. The great part about this approach is that it gives clear trade entry and exit signals.

Ema trading how to#

You can set up a custom screen in altFINS to catch these opportunities by using these criteria.īelow is a tutorial video on how to create this custom screen. Buy when EMA 12 crosses above EMA 50 and Price is above EMA 12.This strategy uses the 12 day and 50 day Exponential moving average (EMA). EMA 12 / 50 is a simple trend following strategy using moving average crossovers. W e also recommend setting up Alerts for specific EMA or SMA crossovers. altFINS constantly scans over 1,800 altcoins to identify signals:

To quickly and easily find cryptocurrencies news with EMA or SMA crossovers, bullish or bearish (across 4 time intervals), check our Signal Summary page. You can also combine multiple EMA crosses (5/10, 5/20, 5/30, or 5/10, 10/20, 20/30, etc.) to strengthen the signal power of your screen. For instance, you can find coins where 5-day EMA has crossed the 10-day EMA.

You can improve your success rates (reduce false signals) by combining moving average crossovers with other indicators like MACD (momentum), RSI, and OBV, among others.ĪltFINS allows you to compare EMAs. However, you should get fewer false signals, hence a higher win rate. Using longer term moving averages (30, 50, 100, 200 periods) will result in detecting a trend later, when it’s more established, but perhaps with less upside potential left since you’re jumping on the trend a bit later. Using short term moving averages (5, 10, 12, 20, 26 periods) will result in detecting a trend early, with high profit potential, but with many false signals (i.e. It depends on how early or late you wanna be, and how many false signals you’re willing to work with.ġ. There are many moving average crossover trading possibilities (EMA 12/26, EMA 26/50, SMA 5/10, SMA 10/30, etc.). Hence, EMA reacts quicker to price changes and provides an earlier trend signal than SMAs. You can read about differences between Simple Moving Average (SMA) and Exponential Moving Average (EMA), but in short, EMA puts greater weight on the most recent prices, and thus has less lag than SMAs. 50 day), either above (bullish, uptrend) or below (bearish, downtrend). Trading EMA (or SMA) crossovers is a foundational strategy for trend trading.ĮMA crossover occurs when a short-term EMA (e.g. Overall Score of Oscillators (Oversold / Overbought)Įxponential Moving Averages (MA) help identify 1) price trends and 2) potential support and resistance levels.Strong Up / Down Trend and Strong / Weak Ultimate Oscillator.Strong Up / Down Trend and Oversold / Overbought.Bollinger Band - Price Broke Upper / Lower Band.

0 kommentar(er)

0 kommentar(er)